If equity markets suddenly sprang into existence now, would we create market indices? I’m doubtful.

Why an index?

The Dow Jones Industrial Average was born in 1896. This was when computers were humans with adding machines (but they did do parallel processing). At that point boiling “the market” down to a single number had value.

The two main uses of a market index are:

- general sense of market direction

- benchmark for a fund

Why not an index?

Now “computer” has a new meaning. We don’t have to rely on 19th century solutions.

The market is not one-dimensional — a single number is not an adequate description.

Using an index as a performance benchmark is effectively useless. It works if you have decades of information on the fund and you are willing to assume that the skill of the fund is constant throughout those decades. The alternative is random portfolios which can be used to get coherent performance measurement.

Better than an index

If you are after description, then better than a number is a picture. Perhaps like Figure 1.

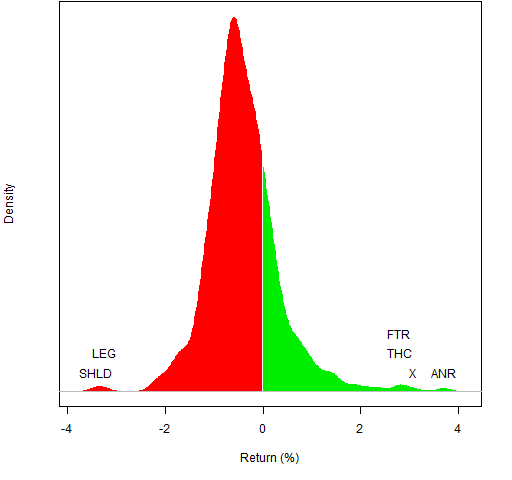

Figure 1: S&P 500 constituents on 2011 December 30.  Figure 1 was the last trading day of 2011, Figure 2 is the first trading day.

Figure 1 was the last trading day of 2011, Figure 2 is the first trading day.

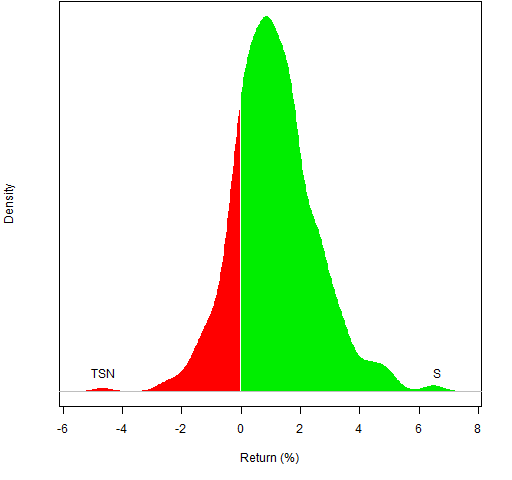

Figure 2: S&P 500 constituents on 2011 January 03.

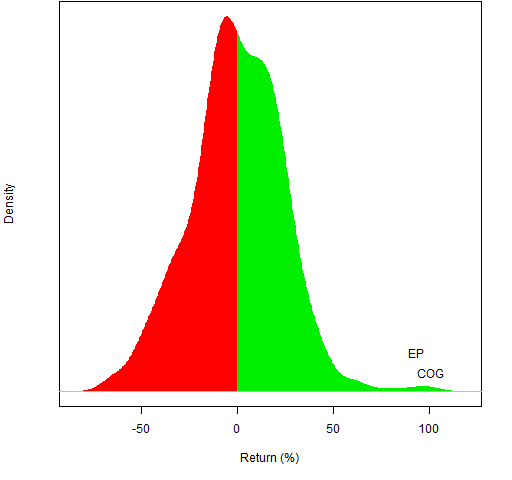

Of course, you can use any time frame that you like. Figure 3 is for all of 2011.

Figure 3: S&P 500 constituents in 2011.  The returns in Figures 1 through 3 are simple returns. For the daily returns, the difference between simple and log returns is minimal. But it matters for the annual returns as can be seen in Figure 4.

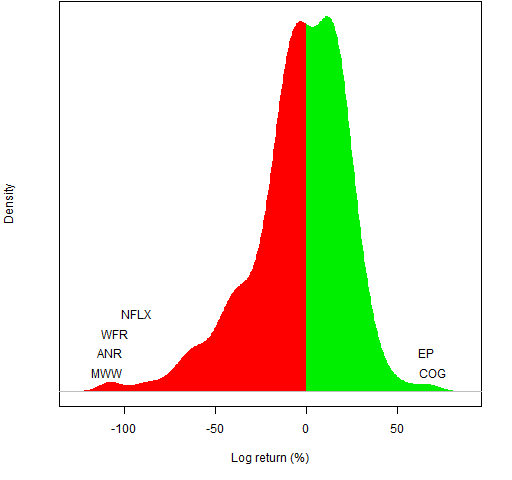

The returns in Figures 1 through 3 are simple returns. For the daily returns, the difference between simple and log returns is minimal. But it matters for the annual returns as can be seen in Figure 4.

Figure 4: S&P 500 constituents in 2011 with logarithmic returns.

Questions

What other uses of indices are there?

How can the plot be improved?

Update (2012 May 20):

Now the quartiles are indicated in gold on the axis. The middle half of the data are inside the gold bars. The distance between the gold bars is also stated as the interquartile range.

Update (2012 April):

The idea of a commentator has been taken up, and the fractions of postive returns and of negative returns are stated.

Update: Weekly market portraits are now produced for the US.

Appendix R

The R function that drew the figures is pp.marketdistrib — its definition is in pp.marketdistrib.R

getting the function

The easiest way to get the function is to start R and then do the command:

source("https://www.portfolioprobe.com/R/blog/pp.marketdistrib.R")

identifying assets

The main argument to the function is a vector of the returns of the assets. If that vector has names, then the function allows you to identify the extreme assets with the ident argument. The flexibility of R lists allows the possibility of easily stating how to arrange the labels so they don’t overwrite each other.

The labels for Figure 2 are easy since there is no overwriting. We don’t need to use a list in this case, just a length two numeric vector saying how many we want labelled on each side — one in both cases here:

ident=c(1,1)

Figure 3 is more complex: we want no labels on the downside and two labels on the upside — but they would collide with each other if they were written on the same line:

ident=list(NULL, list(1,2))

Figure 1 is the most complex: we want to write more than one label on the same line plus others:

ident=list(list(1, 2), list(1:2, 3, 4))

You should change the x-axis scale to logarithmic in Fig. 4, because it appears like there are stocks that had a return of below -100%.

A scale on the y-axis would be nice (percentage, absolute numbers).

One way to improve the plot would be to calculate the area-under-the-curve of both the return>0 and return<0 sides, and chart this over time.

st0ckthief,

Thanks for the suggestion of stating the percent assets with negative/positive returns. I’ll probably experiment with that.

Log returns can be less than -100% — they go to negative infinity. That is one of the reasons that log returns are more common in mathematical models than are simple returns.

I had to work to get rid of the numbers on the y-axis (this is R, so it wasn’t much work). I think they are a distraction rather than an aid.

Pingback: Monday links: what are indices good for? | Abnormal Returns

The missing link with indices has always been the lack of valuation signals and portfolio construction in the index. We’d replace indices with “strategy indices” that calculate the return to, for example, stocks with low book to market ratios.

Capital markets guy,

It seems to me like you are talking about fundamental indices. Perhaps we would do that, but I don’t think we should. When you create an index, you throw away the dispersion of the strategy.

Much better, I think, is to create a set of random portfolios that follow the strategy and then show the distribution of their returns (similar to the plots in this post).

Pingback: US market portrait 2012 weeks 38 and 39 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2012 week 49 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2012 week 45 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2012 final | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2012 week 24 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2013 week 9 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2012 week 17 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2012 week 18 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2012 week 19 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2012 week 21 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2012 week 27 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2012 week 30 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2012 week 31 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2012 week 32 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2012 week 33 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2012 week 36 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2012 week 37 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2012 week 40 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2012 week 42 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2012 week 43 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2012 week 46 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2012 week 47 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2012 week 48 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2012 week 51 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2012 week 52 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2013 week 1 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2013 week 8 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2013 week 15 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2013 week 16 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2013 week 27 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2013 week 32 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2013 week 37 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: On smart beta | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2013 week 43 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2013 week 46 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2013 week 51 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: S&P that might have been | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 2 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 3 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 4 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 5 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 6 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 7 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 8 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 10 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 11 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 12 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 13 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 14 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 15 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 16 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market update 2014 week 17 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 18 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 19 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 20 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 21 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 22 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 23 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 24 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 25 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 26 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 27 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 28 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 29 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 32 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 33 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 34 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 35 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 36 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 37 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 38 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 39 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 40 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 41 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 42 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 43 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 44 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 45 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 46 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 47 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 48 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 49 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 50 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2014 week 51 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait year 2014 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 2 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 3 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 4 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 5 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 6 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 7 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 8 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 9 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 10 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 11 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 12 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 13 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 14 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 15 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 16 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 17 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 18 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 19 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 20 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 21 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 22 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 23 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 24 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 25 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 26 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 27 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 28 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 29 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 30 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 31 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 32 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 33 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 34 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 35 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 36 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 37 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 38 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 39 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 40 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 41 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 42 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 43 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 44 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 45 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 46 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 47 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 48 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 49 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2015 week 50 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait final | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2016 week 3 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2016 week 4 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2016 week 5 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2016 week 6 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2016 week 7 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2016 week 8 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2016 week 9 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Pingback: US market portrait 2016 week 11 | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics