Investment Performance Guy has a post “Periodicity of risk statistcs (and other measures)” in which it is wondered how valid volatility estimates are from a month of daily returns.

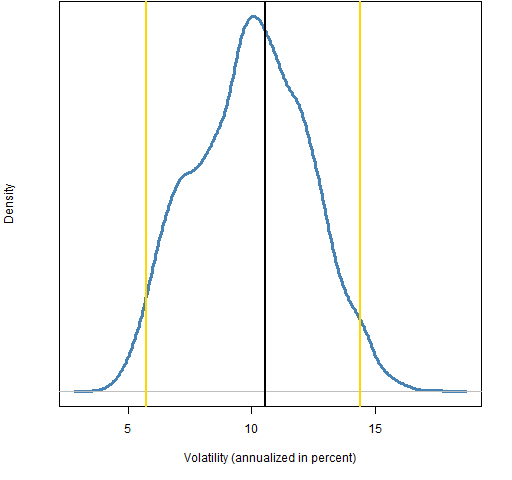

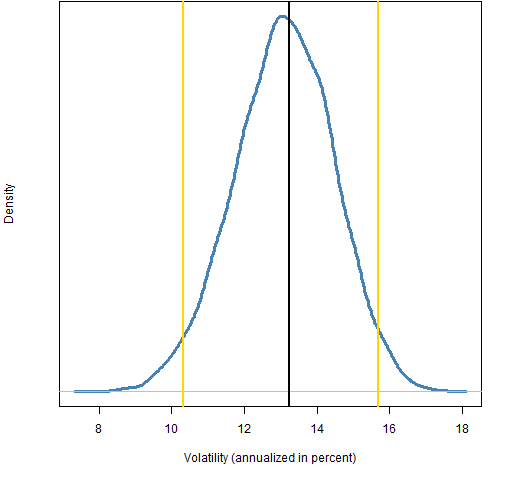

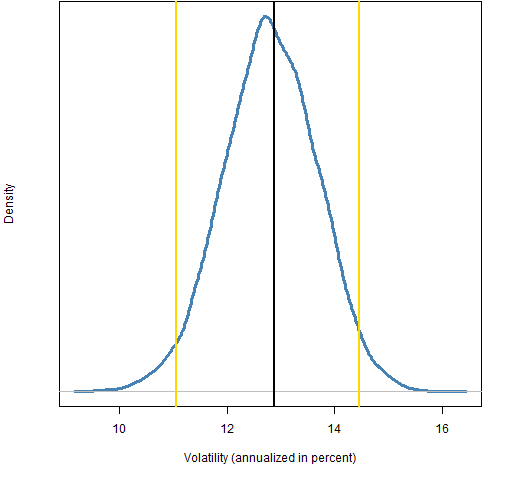

Here is a quick look. Figure 1 shows the variability (and a 95% confidence interval (gold lines) from a bootstrap) of the volatility estimate (black line) for the S&P 500 index in January 2011. Figure 2 is for the first quarter and Figure 3 is for the first half. All of these are with daily data.

Figure 1: Volatility and bootstrap distribution for January 2011 volatility of the S&P 500.

Figure 2: Volatility and bootstrap distribution for Q1 of 2011 volatility of the S&P 500.

Figure 3: Volatility and bootstrap distribution for H1 of 2011 volatility of the S&P 500.

My take

It would be best if the culture changed to include confidence intervals as well as point estimates of volatility.

Appendix R

The bootstrapping is done like:

spxvolQ1.boot

for(i in 1:1e4) spxvolQ1.boot[i] <- sd(spxret11Q1[sample(62,62, replace=TRUE)])

The plots are created like:

plot(density(spxvolM1.boot)*100*sqrt(252))

abline(v=quantile(spxvolM1.boot * 100 * sqrt(252), c(.025, .975)), lwd=2, col=”gold”)

abline(v=sqrt(252) * 100 * sd(spxret11M1), lwd=2, col=”black”)

Pingback: The mystery of volatility estimates from daily versus monthly returns | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics