Before we get to the meat of the subject, I just have to comment on the “modern” of Modern Portfolio Theory.

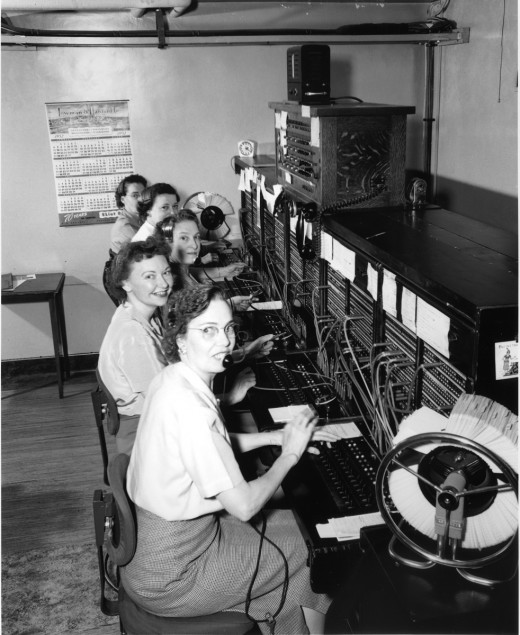

Figure 1: Modern telephone switch

Figure 1 shows us a modern telephone switch. As a bonus we get to see some modern women. Why don’t we have “portfolio theory” instead of “Modern Portfolio Theory”?

Figure 1 shows us a modern telephone switch. As a bonus we get to see some modern women. Why don’t we have “portfolio theory” instead of “Modern Portfolio Theory”?

The most popular post in August on AllAboutAlpha was Modern Portfolio Theory: Break free dude! Why was this the most popular? I’m intrigued.

Normal distribution

The post includes a statement to the effect that MPT (that is, mean-variance optimization) does not apply if returns are not normally distributed. That actually has it backwards. If returns are normal, then mean-variance optimization is effectively all you can do.

The statement should have been something along the lines of: If returns are not basically symmetric or if the assets are time-dependent, then MPT does not apply. Bonds are time-dependent in this sense. You can get a random return by selling them next week, or you can get a known quantity by holding them to maturity. Options both destroy symmetry and are time-dependent. We are essentially left with equity and commodity portfolios.

One way of thinking of mean-variance utility is that it is a two term approximation to a more realistic utility. A four term approximation would add skewness and kurtosis. I’m highly doubtful that skewness can be predicted. We might have a chance with kurtosis, but I haven’t seen any evidence. Anyone else?

Let me add one more thing. If returns are normally distributed, then I’m a bottlenose dolphin. Returns do not have a normal distribution. If you are dealing with annual returns, then they might be close enough. Why is normality considered a possibility?

Convergent and divergent strategies

I’m hoping the popularity of the post was because of the concepts of convergent and divergent strategies. A convergent strategy is designed to work well when markets are calm, a divergent strategy is supposed to work well in turbulent markets. It seems to me that these are well worth considering.

But do we have the Anna Karenina problem? Is each unhappy market event unhappy in its own way? I’m asking if divergent strategies really exist. Does anyone have any data? Or at least further speculation?

(Telephone exchange photo from the Seattle Municipal Archives, dolphin photo from stock.xchng.)

Pingback: Tweets that mention Ancient portfolio theory | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics -- Topsy.com

Pingback: Blog year 2010 in review | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics