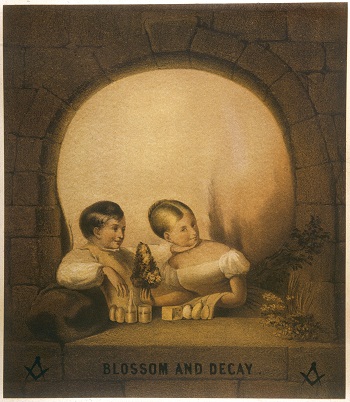

The current New Scientist includes an article about perception switching. They use the figure below.

“Why your brain flips over visual illusions” is about the brain and perceptual switching (the on-line version also has a great video to play with).

These sorts of illusions provide a metaphor for how we should act when doing statistical modeling. We should attempt to see both images simultaneously. We should see both the truth of our model and the deceit of our model.

Modelers have a tendency to fall in awe of their creation. Others may see the imperfections of the model and decide it is worthless. Neither extreme is likely to be optimal.

Remaining aloof is especially useful in finance where reality is dynamic rather than static. Not only do the rules change in finance, but it may be the model that is responsible for change.

It is probably the case that the advent of the Black-Scholes formula changed option prices to more closely follow the model. So using the model made the model more true.

It is undoubtedly the case that the LTCM implosion and the August 2007 quantmare (see A quant review of “The Quants” by Scott Patterson) are examples of models that destroyed their own truth. These models focused only on the happy couple; they didn’t see the skull coming.

(Figure from Mary Evans Picture Library)

Pingback: Blog year 2010 in review | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics