The subtitle is “Central banks, credit bubbles and the efficient market fallacy”.

Executive summary

This is much too important of a book to remain as obscure as it is. Besides, it is quite a fun read.

It talks about two subjects:

- Why markets for goods and services tend toward equilibrium but financial markets do not.

- Why central banks are useful and what they should do (which they currently don’t).

Market stability

The story is well known about how supply and demand work to produce equilibrium:

- higher prices reduce demand and increase supply

- lower prices increase demand and decrease supply

We unconsciously assume that must happen for all markets. Not true. Financial markets are different. There are several mechanisms that push financial markets towards instability. When asset prices rise, then:

- collateral is worth more so even more assets may be purchased

- loans appear to have more safety margin and so carry lower interest

The same process is easier to see on the down side:

- people are forced to sell into a falling market, causing it to fall even more

- interest on loans is increased, or the loans are withdrawn all together

If the stock market is going down, then I’m likely to sell — either because I’m forced to sell because I’m leveraged or because I know that others will be forced to sell. If the price of the can of beans in my cupboard goes down, I’m not going to sell it (but I might buy more).

Tulip mania may seem like a counter-example of goods markets being stable, but at that point the tulips were not bought to put in the ground, they were bought to put in the vault.

Governors

Given that financial markets are unstable — an instability that percolates through the whole economy — there should be a stabilizing mechanism. That is the role of the central bank.

James Clerk Maxwell wrote a paper on steam engine governors — how to get the engine to work just the right amount as the work load changes. You don’t want it to explode, but you do want it to do the work.

Maxwell found that there are four possibilities. He phrased it in terms of “disturbance” — how far off are we from optimal?

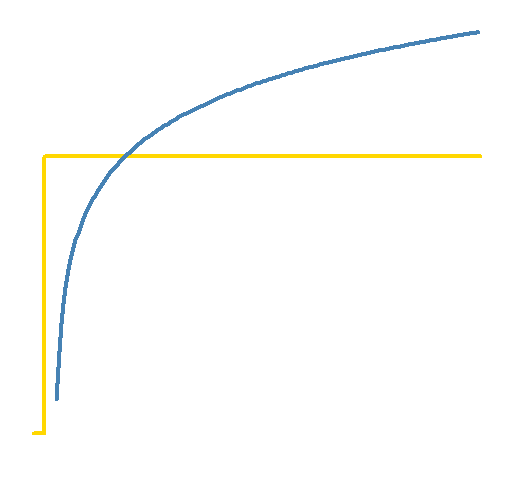

- The disturbance may continually increase.

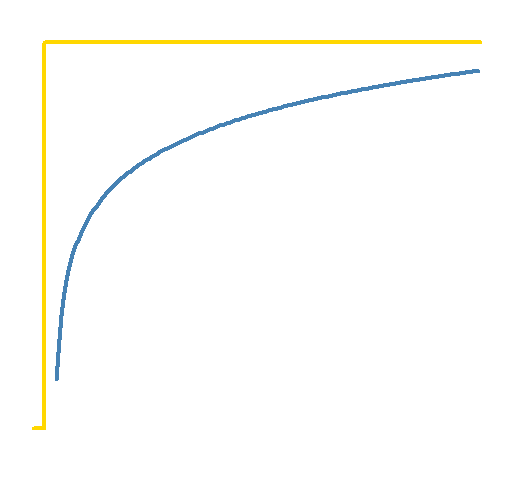

- It may continually decrease.

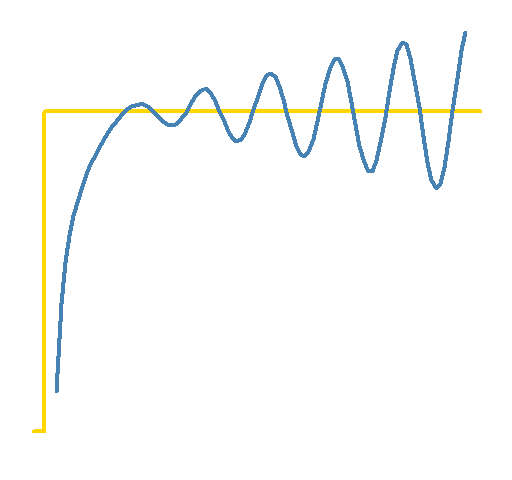

- It may be an oscillation of continuously increasing amplitude.

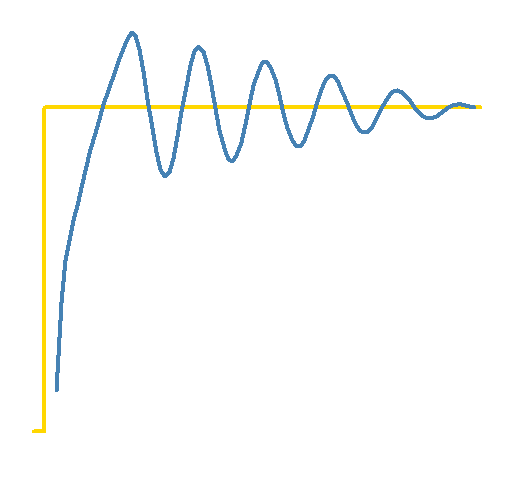

- It may be an oscillation of continuously decreasing amplitude.

Figure 1: Maxwell type 1 disturbance, continuously increasing.

Figure 2: Maxwell type 2 disturbance, continuously decreasing.

Figure 3: Maxwell type 3 disturbance, oscillate with increasing amplitude.

Figure 4: Maxwell type 4 disturbance, oscillate with decreasing amplitude.

Types 1 and 3 are bad. Type 2 is not feasible in a dynamic system. Type 4 is what we should aim for.

The moral of the story is that central banks can not save us from all economic contractions. If they try, then we end up with a gigantic contraction instead.

Wobbly economics

The book uses London’s wobbly bridge as a metaphor for the actions that central banks should take.

Figure 5: The wobbly bridge (via Wikipedia).

Fixing the problem with the wobbly bridge was, in theory at least, a simple task. Damping the motion simply required that sufficiently powerful shock absorbers were anchored between points on the structure

Credit cycles do not have a fixed frequency or mode of operation, and therefore cannot be managed by a simple passive damping system. To make matters worse the agents causing these cycles — companies and households — are able to learn to anticipate the damping process.

The alternative to a good damping system is to be between Tacoma and Gig Harbor.

Figure 6: Tacoma Narrows Bridge on 1940 November 7 (6 minutes).

Contradictions

Sleight of hand

This logical trick is pervasive in economic teaching: we are first persuaded that the markets for goods are efficient, and then beguiled into believing this to be a general principle applicable to all markets.

Instability

The banker therefore lives a precarious existence, grabbing for higher loan rates on the one hand, while constantly nervous of default on the other.

These problems are manifest in a damaging pro-cyclicality of credit ratings, whereby ratings are revised upward in a boom, making borrowing easier, and downward in a bust, making borrowing more difficult. This problem could be addressed by revising the structure of credit ratings, requiring the agencies maintain a constant fraction of their ratings in each rating bucket at all times.

Money supply

… whereas “money supply growth” has a reassuring ring to it — more money can not be a bad thing — it does not mean just more money, it also means more debt. … Much of the fog of confusion surrounding macro finance would be lifted if these numbers were reported under the more chilling moniker of “debt supply growth”.

Lopsided policy

Even if we were unwise enough to wish to prick an asset price bubble, we are told it is impossible to see the bubble whilst in its inflationary phase. We are also told, however, that by some unspecified means the bubble’s camouflage is lifted immediately as it begins deflating, thereby providing a trigger for prompt fiscal and monetary stimulus.

While asset prices rise and credit expands, the doctrine of market efficiency reigns supreme. But immediately as asset prices begin falling and the credit bubble begins contracting, the singers swiftly change tune. The free-marketeers cast aside their message and, without even the decency to blush, strike up a new song …

Central banks

History shows quite clearly that financial instability came before central banking. This point is well made by examining the events behind the 1907 crisis in America that occurred in the absence of a central bank.

It may be useful to think of this new arrangement between governments and central banks as something akin to that between an habitually drunken lord and his trusty manservant. In a moment of hungover sobriety, the lord hands the keys to the drinks cabinet to the manservant, instructing him to ration his future drinking.

In this particular crisis the central banks have played the role of attendant paramedic with some skill but only after first playing the role of drunk driver.

The major central banks have adopted a pattern of behaviour whereby they pre-warn the financial markets of forthcoming policy actions. It may, however, be advisable to head in exactly the opposite direction. By mandating the bank to deliver occasional short, sharp shocks — sudden unexpected withdrawls of liquidity — the banks may be able to perform the equivalent of a fire drill

Put differently, the central bank would be moving its focus from the management of the inherently stable goods markets to the inherently unstable capital markets — if we are going to have a governor we should at least attach it to the part of the machine whose motion requires governing.

Economic theory

The scientific method requires, first and foremost, that theories be constructed to accord with facts. On this count the economic orthodoxy does not qualify as a science.

Minsky’s theory, with financial markets flipping between self-reinforcing expansions and contractions, explains real financial market behaviour. Until better ideas come along, we should adopt the Financial Instability Hypothesis as our working assumption of how our financial system really works.

Favorite sentence

Actually two, one from the book but first a quote:

Bank failures are caused by depositors who don’t deposit enough money to cover losses due to mismanagement.

— Dan Quayle

I had to do some due diligence on this one — it has to be a joke, right? But apparently not.

The book includes a description of the course of history that led to fractional reserve banking. Hence the observation:

Needless to say, the combination of bankers and large piles of unused money was not a stable equilibrium.

Editions

The paperback edition is cheaper of course. It also has a little additional material, apparently.

Appendix R

The R functions that created the sketches of the Maxwell governor types are in maxwell_governors.R. Ideas for easier ways to produce the oscillating curves are welcome.

I’ve not read the book, solely this exposition. With regard to market stability for goods, you (the book?) ignore the first semester econ presentation: the farmer’s dilemma, high prices one season leads all farmers to increase production the following season, thus leading to crashing prices the next. This problem was “solved” (at the farmers’ demand) with guaranteed prices. Most goods; markets behave with similar instability, although price control generally rests with the oligopoly.

The notion that currencies are tradeable goods is a large part of the problem. Without sovereign control, central banks are subsumed to large private actors; IMF and WB among them. I keep a quote from Eccles at the top of my site, to the effect that no industrial economy can survive without a working theory of distribution. Worth remembering. As we can readily see, the auto industry has reached, for them, a comfortable equilibrium at significantly lower supply. Whether this will prove equally happy for US citizens is another matter.

Our current Great Recession was the direct result of political manipulation, mostly two: Gramm-Leach-Bliley repeal of what remained of Glass-Steagall, and Greenspan’s suppression of interest rates, these were political decisions not economic ones. Add in the shift to Chinese production, significant in that this is what generated the massive store of cash (some call it “savings”) which eventually ended up in the housing market, since it was “obvious” that housing was a safe way to earn more than the suppressed interest rate. This was *not* a failure of US monetary policy but of politics. If anything, it was a failure of international exchange rates to level China with RoW.

Some, humble self included, recognized as early as 2003 that the ratio of median home price to median income had already greatly diverged from historical norm, AND that median income was, at best, stagnant. Corruption of the lending process was the only way to explain this. It went ignored because Dubya wanted to. The winners in all this, of course, have gone largely unmentioned: corporate house builders. They built, and got well paid, for all those now worthless McMansions. That they have gone unpunished is the greatest tragedy.

Economics was originally termed Political Economics, and the infiltration of the field by the failed math/physics/engineering Ph.Ds in the 1970s has accelerated the incompetence in the field. Almost all problems in economics are of policy. Using quants to determine how policy may play out is worthwhile. Using quants to determine policy is a waste of time.

Robert,

Thanks for your comments. The issue of central banks and politics is discussed a little in the book.

Pat,

The assertion that Type 2 responses are not possible in dynamic systems is not correct. Type 2 repsonse is called an over-damped response (Type 4 under-damped). If I’m not mistaken nearly every dynamic system (I’m an engineer so I’m thinking of mechanical/electrical systems specifically here but it would apply equally to financial/economic models too) can be turned from Type 4 response to Type 2 by adding in more damping. In fact this is used in control system engineering to shape the type of response you want. However, not all Type 2’s can be turned into Type 4’s by reducing damping as some dynamic systems (1st order) do not have an inherent oscillatory response to a disturbance.

Regards,

Joe

Pingback: Popular posts 2012 March | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

Given that financial markets are unstable — an instability that percolates through the whole economy — there should be a stabilizing mechanism. That is the role of the central bank.